The dotcom revolution has brought a sea change in the way businesses operate, and people live. Giving a fillip to a cascade of technological advancements, the advent of the internet has affected various industries, Finance, being one of them. Engaging with financial institutions is much easier and hassle-free now, unlike some time back, when there were no computers, smartphones or internet. With Crowdfunding, Bitcoins, mobile payments, Robo-advisers, etc., coming to the forefront, it looks like there is no limit to the number of innovations in the Fintech ecosystem.

From bringing complete automation in financial transactions to providing instant services to customers, the Finance sector has broken all the shackles by moving out of its traditional zone, to give its patrons seamless and flawless experience. Below are some of the ways by which technology is transforming the Finance landscape across the world.

Complete automation – By fully automating the manual and paper-based operations, that require more resources, Fintech firms are lowering their operational costs to a great extent. This has also raised the number of self-service options for users. Heightened customer service and significant cost reduction are the two major benefits that Fintech companies, as well as banks, are enjoying. JP Morgan Chase has conjectured that the cost incurred by serving online bank accounts is 70% lesser for every household than the cost of managing traditional accounts.

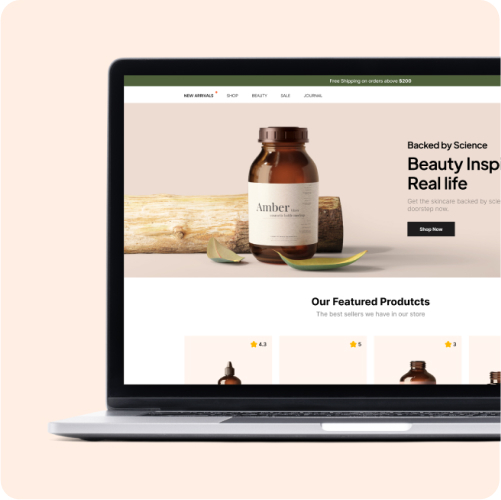

Customer-friendly products and services – Previously, Fintech companies tried to follow the banking system, but with time they realized that they cannot replace banks. With a little twist in their ways i.e. by sticking to providing banking products and services like faster national and international money transfers at a reasonable cost, is giving them a new identity and helping them carve a niche in the Finance industry.

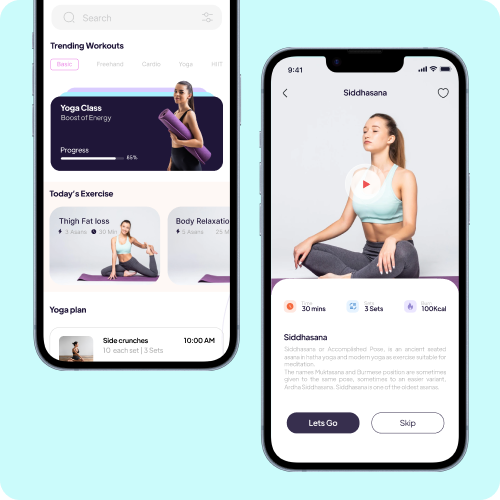

Easier Banking – The emergence of mobile phones is driving growth and profitability for banks. Mobile banking enables banking institutions to tap a wider audience base that includes those customers who are conventionally out of reach of banks. With cognitive computing, banks are able to provide personalized financial advice to their patrons who are in need of the same but cannot bear the cost charged by private banks. Also, customer engagement becomes better with mobile as a transaction platform as going digital enables banks to offer not just financial but also non-financial services like providing assistance to customers for purchasing houses. This is executed impeccably by The Commonwealth Bank of Australia that has rolled out its mobile app that comprises of the list of various homes available for purchase in the country and helps those looking out for a property to get the best price.

Online Currency – Virtual currencies like Bitcoins are slowly gaining momentum in the Finance sector. Once these come into the mainstream, dealing in financial transactions like transferring money or trading, will become speedy and hassle-free. Besides this, they will also decrease the costs associated with these activities. Currently, online currency is still not considered a favorable transacting medium in the financial landscape, but with time, it might become one of the most preferred ways of dealings. Bitcoins have been in the news since their launch in 2009, and therefore, Blockchain, the technology that they are based on has attracted many companies like Goldman Sachs and PwC. According to them, Blockchain is a cutting-edge innovation that will draw a million eyeballs in the near future.

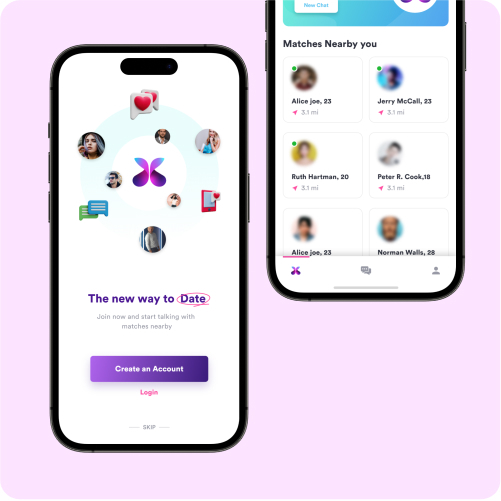

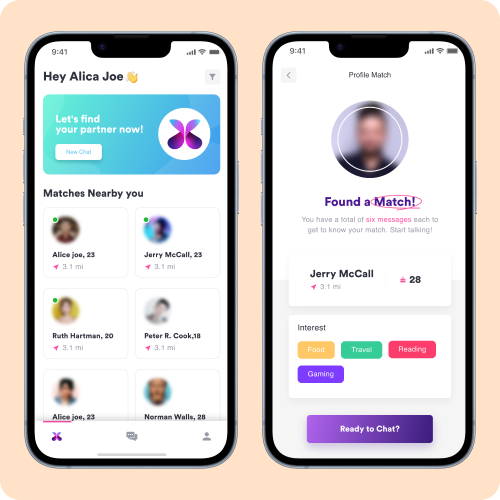

Easier access through mobile apps – With the rising usage of smartphones, the need for mobile apps for anything and everything, has increased enormously. Phones have become the easiest way to access financial markets for trading, do transactions like transferring money or seek advice on money-related matters. Mobile applications embedded in handheld devices have eased out the otherwise cumbersome procedures of opening or closing a bank account, checking transactions, getting information about the bank balance or requesting for a new ATM card. One swipe is all it takes to do all of this.

Cloud – This path-breaking technology is bringing ripples across the Finance sector and might completely transform it in the coming years. The major reasons why Finance companies are switching to cloud technology are decrease in operational as well as ownership costs, efficiency in infrastructure and reduction in time to market. Finance dominant companies are still at a rudimentary stage as far as embracing Cloud technology is concerned, with Cloud Security Alliance confirming that a meager 18% of the firms in this sector have a full-fledged cloud strategy in 2015.

Simplifying complex processes and improving user experiences, Fintech is the proverbial ‘Next Big Thing,’ in the corporate sector.